Invoice Finance is known by many different terms such as: debtor finance, invoice finance, invoice factoring, debt factoring, invoice discounting, cash flow funding. When it comes to unsecured business loans and business finance, invoice finance is widely used around the world.

The rise of ‘Buy Now. Pay Later.’ offerings are well accepted and entrenched in the consumer market. Invoice Finance is a very similar scheme but aimed at business to business transactions.

An Invoice Finance Facility grows as your sales grow. The more you sell, the greater the access to cash you have available. It’s a positive upward cycle. It gives you a cashflow boost exactly when you need it.

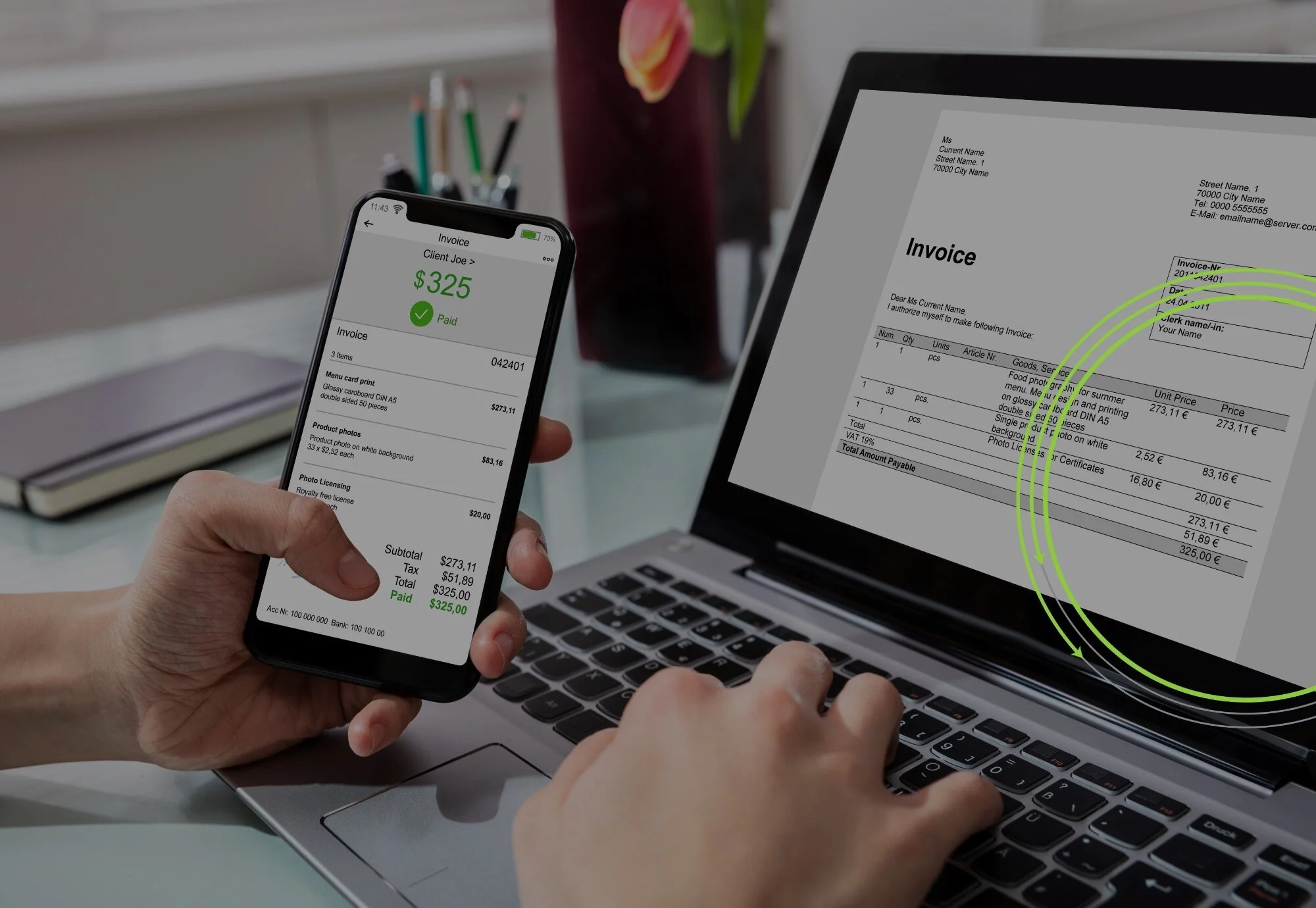

INVOICE FINANCE IN 3 EASY STEPS

You complete a job, invoice your client and send us a copy.

We verify the invoice and advance up to 90% of the invoice value (inc. GST) within 24 hours.

Your customer pays the invoice to us as per trading terms and we return the balance to you less our fees.

offering Extended Payment terms, particularly of 30 and 60 days, are a commercial reality and can give a well-funded and astute business a competitive advantage. There are many reasons to negotiate extended payment terms with clients such as:

It builds trust in a commercial relationship and brings customer loyalty.

It facilitates larger orders, that equals more sales.

Gives you an advantage over competitors, who don’t provide credit.

It stops providing large discounts for payment, discounts that your customer comes to expect.